Get In Touch

hello@untangld.co

Get In Touch

hello@untangld.co

Follow

|

LinkedIn

We use cookies to make sure you have the best experience on our website. Fear not, we don’t sell your data to third parties.

Underestimating your competition by failing to do due diligence never ends well. Resist the temptation to skip – or skimp on – this step. Instead, level-up your competitor intelligence with these three go-to tips for getting more out of your analysis.

Comp reviews can quickly become rote and uninspired with results to match, but establishing tailored, non-traditional criteria meaningful to the category helps uncover insights faster.

A good guide for what to include in these criteria is what’s most important – either spoken or unspoken – to customers of your category. For example, we recently reviewed digital experience across brands in health insurance – a product with complexity and grudge-buy issues. How does the digital experience reaffirm or challenge these perceptions? Integrating these and other pain points into our review led us to ask more purposeful questions of our analysis, such as:

– Does the DX of Brand A encourage people to engage and improve their understanding? (Complexity)

– Does it feature meaningful personalisation, so people feel less like a number? (Grudge buy)

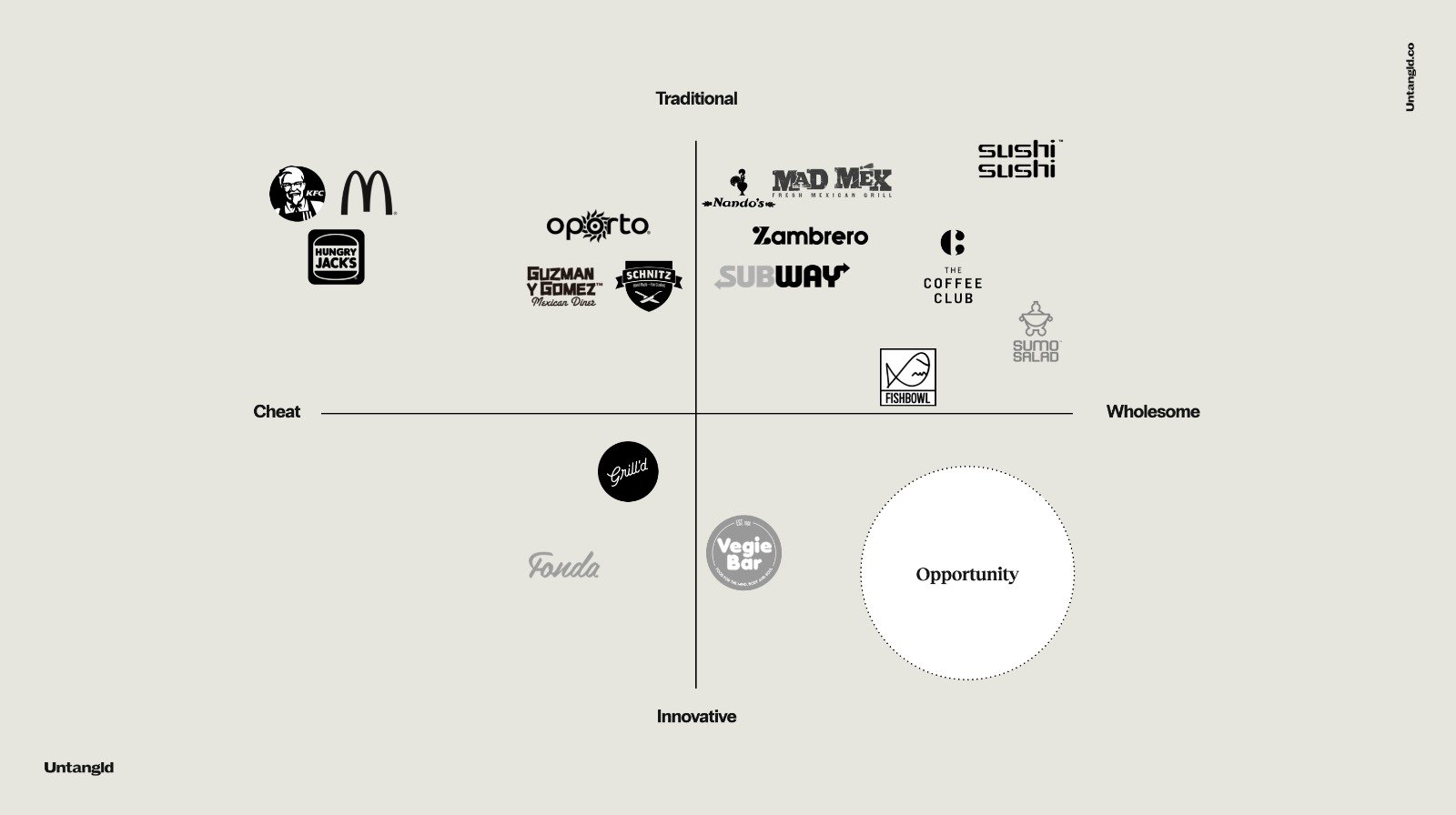

If the key to comp reviews is getting a handle on where the competition is at, what it means for your brand is the point. Beyond collecting intel on competitors, the real value is in understanding its relative importance. A simple matrix that groups brands closer or further away from the dominant category conventions helps show how the category is zigging and your clearest opportunity to zag.

Defining the best axes to make sense of your category can be tricky, but good starting points include:

Mapping the casual dining category

Beyond illuminating those white spaces, comp reviews can be directional, helping brands identify where to strike first.

Find the detail your competitors may be glossing over – overlooked sources are often excellent for insight. Recently, we worked with a brand that counted every click in competitors’ application processes, then decided to halve that number. Similarly, July luggage trawled Trusted Reviews for the most complained-about features of competitor bags, then doubled down on a product to excel in those areas.

For challenger or resource-constrained brands that want to hit the ground running, surfacing competitor blindspots to leapfrog the big guns helps isolate, prioritise and park areas for improvement.

The ultimate value in competitor reviews is putting yourself in a position to see the bigger picture around your brand and draw meaningful conclusions. So, if you know you could be raising your game, tweaking your review approach to take you from the ‘what’ to the ‘so what’ and even the ‘what now?’ will help level-up your competitor intelligence.

→ As a strategist, Lauren has honed and grown her craft across multiple network agencies, leading the strategic charge on brands such as Monash University, Public Transport Victoria, Defence Force Recruiting, Bonds and 7-Eleven. An advocate of an audience-first approach, Lauren enjoys the pursuit of new insight and counts brand and comms strategy, consulting, and understanding data among her strategic skills.